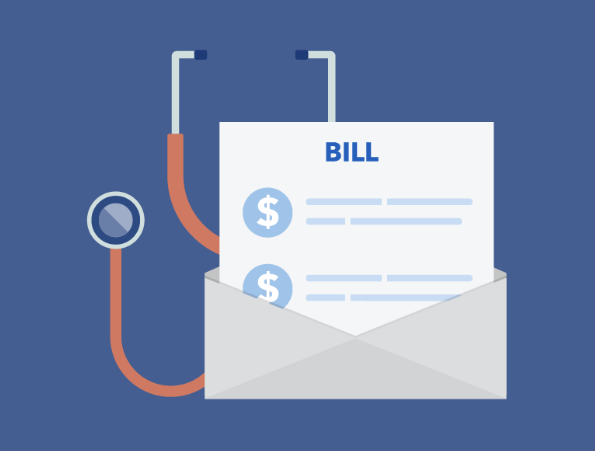

As the infamous campus plague begins to spread, the sound of sneezes and sniffles echoes through lectures and hallways. No matter how vigilant we may be, sometimes getting sick is inevitable, and it is best to be prepared before you find yourself surrounded by tissues and cough drops. This post will focus on five things to know before you find yourself in the doctor’s office and will help you protect yourself and your wallet.