Black Finance: 9 Black Finance Leaders

Celebrating Black Financial Leaders! Throughout Black History Month in February and year-round, we honor the contributions of Black individuals and communities in finances. Honoring both Black history and culture is necessary for acknowledgement, reflection, and inspiration to amplify the voices and achievements of Black financial leaders, both in the past and present. Below, we shine a spotlight on Black financial leaders who have paved the way for economic empowerment and financial success.

Maggie Lena Walker

Maggie Lena Walker was the first Black woman to establish and serve as president of a bank in the United States. Walker found that white-owned banks didn't typically take deposits from Black organizations, so, in 1903, she started her own bank, St. Luke Penny Savings Bank, in Richmond, Va., with money gathered from members of the Independent Order of St. Luke, an African American benevolent society. It was renamed Consolidated Bank & Trust after merging with two smaller Black-owned banks in 1930. Walker also chaired the board of directors. The bank was still in operation and was the oldest continuously operated African American-owned bank in the U.S. until 2005, when a series of ownership changes led to Peoples Bancorp acquiring the bank in 2021.

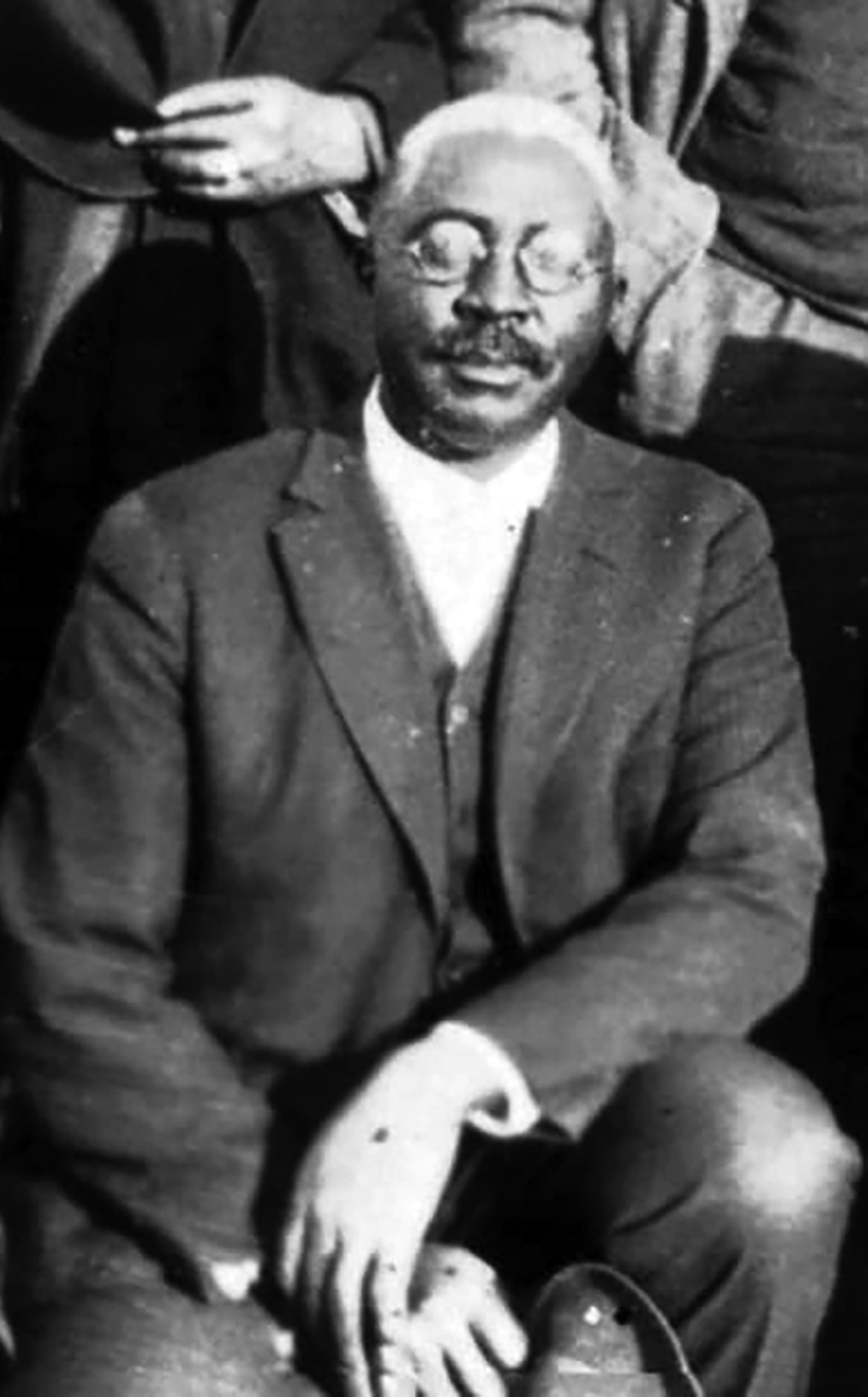

O.W. Gurley

O.W. Gurley moved to Tulsa, Oklahoma, in 1906, where he purchased 40 acres of land on what would become Greenwood, a community known as Black Wall Street. Gurley ran many businesses of his own and supported other entrepreneurs in their business endeavors. Greenwood became a thriving center that included law offices, medical practices, luxury shops, restaurants, movie theaters, barbershops and salons. It had its own school system, post office, bank and bus service. Michelle Place, executive director of the Tulsa Historical Society and Museum, told History.com, "It is said within Greenwood every dollar would change hands 19 times before it left the community." The town was devastated in 1921 during the 18-hour Tulsa Race Massacre, also known as the Tulsa Race Riot, when a white mob committed what is still one of the worst acts of racial violence in U.S. History.

Alonzo Herndon

In 1905, Alonzo Herndon founded the Atlanta Life Insurance Company, still one of the largest Black financial institutions in the United States. Formerly enslaved, he became a barber and eventually opened the Crystal Palace, a barbershop to elite white men. Historian Dr. Marcellus Barksdale told Georgia Public Broadcasting that, at one time, Herndon owned three barbershops and 100 properties in Atlanta. He became Atlanta's first African American millionaire.

Lilla St. John

Lilla St. John was the first Black woman to pass the New York Stock Exchange exam in 1953. She was 25, a mother of two children and crammed for only two months. She became the first certified female investment counselor in the U.S., starting her finance career at Oppenheimer & Company. Prior to her interest in investing, St. John, a soprano singer, hosted her own music television show in Milwaukee.

Tiffany Aliche @thebudgetnista

Tiffany Aliche @thebudgetnista

Tiffany Aliche Known as “The Budgetnista,” personal finance expert Tiffany Aliche has created a financial movement that provides women with the tools and resources needed to save, purchase homes and change the way they think about money. Her efforts have been wildly successful: She estimates that through her company, she has helped more than 800,000 women worldwide collectively save more than $100 million. But this wasn’t her original life plan. She started out as a preschool teacher in New Jersey, a job she worked at for a decade. She’s since partnered with state Assemblywoman Angela V. McKnight to write a bill that was signed into law in 2019, making it mandatory for financial education to be integrated into all New Jersey middle schools.

Kevin L. Matthews II @buildingbread

Kevin L. Matthews II @buildingbread

Kevin L. Matthews II is a former financial adviser turned investment educator. He has taken what he learned helping clients manage multipmillion dollar portfolios and created a platform, BuildingBread, where he helps befinners start investing and building generational wealth. He is also the author or "From Burning to Blueprint: Rebuilding Black Wall Street After a Century of Silence."

Dasha Kennedy @thebrokeblackgirl

Dasha Kennedy @thebrokeblackgirl

Dasha Kennedy, better known as The Broke Black Girl, is a millennial financial coach whose no-B.S., real-talk coaching and strategies are helping women of color like her get ahead.

"By no means am I ashamed of my past financial struggle, in fact, I've completely embraced it. After a tough life event made me realize how financially unprepared I was, I began sharing my own journey towards financial success on Facebook. The Broke Black Girl (BBG) Facebook group, launced in November 2017, focuses on the financial struggles facing young women of color like me, who have often been overlooked in the traditional conversations around personal finance. Within a year the group has skyrocketed to over 60,000 women."

Patrice Washington @seekwisdompcw

Patrice Washington @seekwisdompcw

Patrice Washington is the founder and CEO of Seek Wisdom Find Wealth, Patrice Washington is a personal finance maven focused on helping people move from debt management to money mastery. After becoming a licensed real estate agent at age 19 and obtaining her mortgage broker’s license at 21, she built a seven-figure business by the time she was 25. When the 2008 recession hit, Washington’s company wasn’t able to recover. She lost her home to foreclosure and started sleeping on her brother’s couch. Without her personal experience, however, Washington says she wouldn’t be able to provide the insight she offers today. Amid running her company, she’s also been the personal finance expert on Steve Harvey’s radio and television shows and has been featured in hundreds of publications, sharing her riches-to-rags story. "I believe that the life and prosperity you desire is your birthright."

Kiersten and Julien Saunders @richandregular

Kiersten and Julien Saunders @richandregular

Kiersten and Julien Saunders want to shatter the notion that talking about money is taboo. With their platform Rich and Regular, this couple’s mission is to inspire better conversations about money. Watch the Saunderses’ web series “Money on the Table” on YouTube. In the second season of the series, they chat with a variety of special guests on topics like entrepreneurship, estate planning and investing. Or keep up with their blog for updates on their financial journey.