What I Learned From the Intentional Spending Challenge

Recently I wrote a course on Intentional Spending. After doing research for the course and watching my students progress along it, I’ve learned a lot about how to align your budget and money habits to your goals. Here are some of the beginning steps I recommend taking to start an intentional budget.

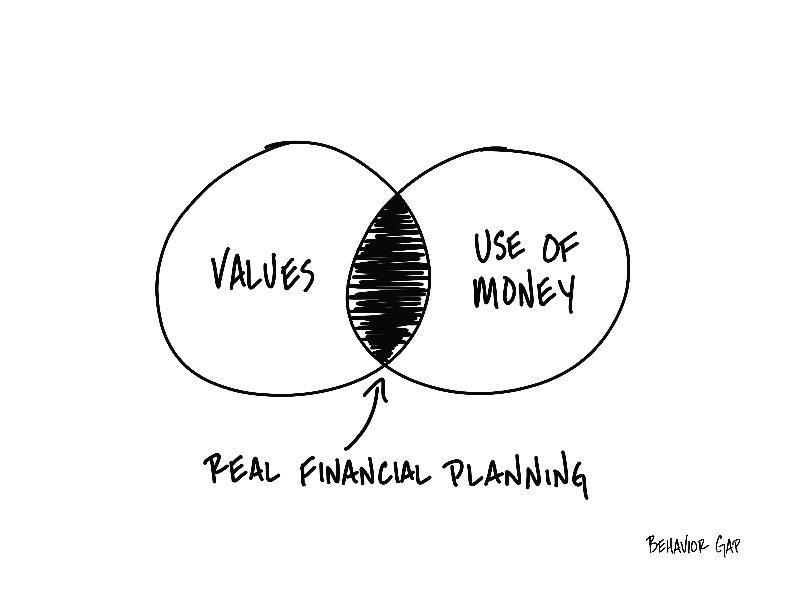

First, understand your money values.

In other words, understand what type of position you want to be in with your money. A lot of people value security, so they make huge emergency savings funds. Other people value passive income, so they’d rather have less cash and a high number of investments. Some people don’t care that much to have larger net worth and would rather put the money towards experiences. Understand also what type of risk tolerance you have. How much of your money are you willing to sacrifice for higher returns? With this in mind it’s easier to understand our goals and sustainably budget for them.

Secondly, get closer to your goals and farther from your money.

Money is almost always an emotionally charged subject. Some people don’t like to think about it, others cannot stop thinking about it. Some like to hoard it, others cannot hold it. In order to live intentionally we ought to distance ourselves from this emotional representation of money. Never make a dollar worth any less or more than it actually is. Money does not control you, you control it, and outside of money you can live a satisfying and fulfilling life.

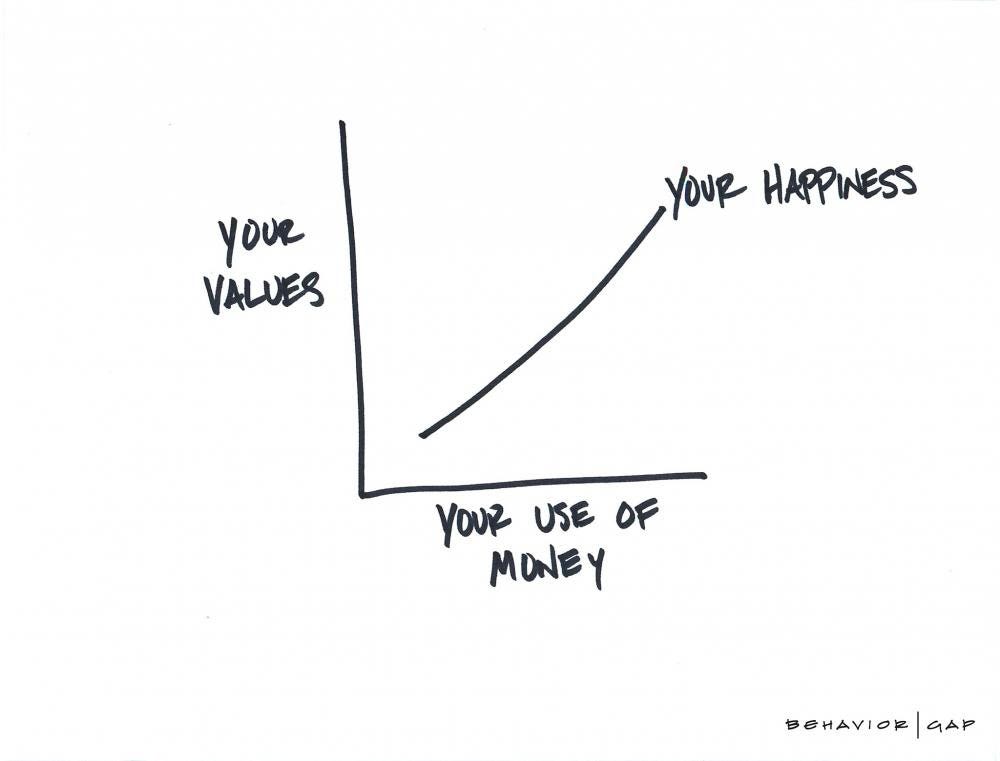

Our goals are probably the subject that we don’t think about enough when it comes to money. Reflect on what type of lifestyle you actually want to buy for yourself. If all you want is to live in an apartment in the Big City, amazing. If you want to live out in a rural town riding horses every day, amazing as well. Maybe you actually don’t want much except to travel and create memorable experiences, great focus on that. If you want a big flashy life with fancy cars, big houses, and expensive dinners, yes you can have that be your goal. However, when thinking about your goals, remember to think about why you want those. We often don’t realize how often we do things for other people, rather than ourselves and our own fulfillment.

Thirdly, make sacrifices based on your financial goals rather than your financial fears.

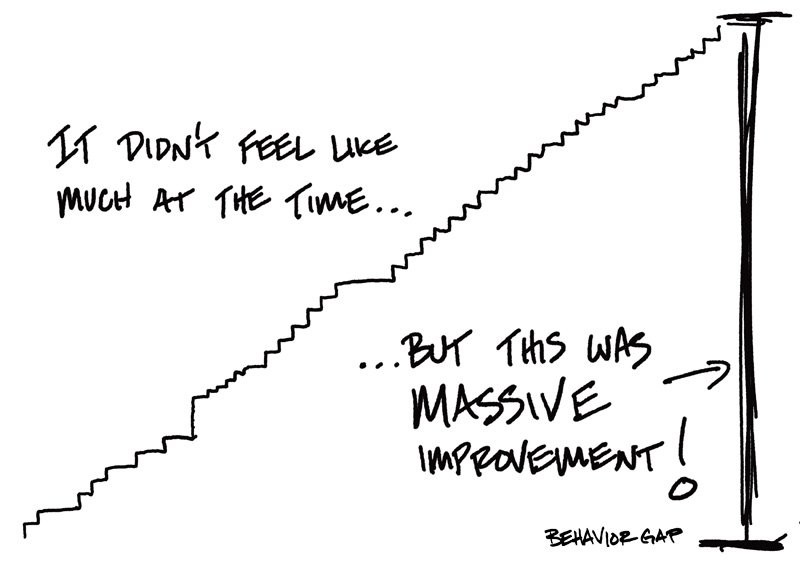

Once you know your goals you can reflect them in your budget. Yes, you will need to make sacrifices for those goals, especially as a college student. That weekend trip in Moab could be fun, but if it is going to put your goal of traveling to Europe at the end of the year in jeopardy, are you willing to make that sacrifice? Maybe that new gaming pc would mean you don’t have enough to pay for next semester, how does that align with your goals? And it is okay to choose one over the other, whichever it may be, just put whatever you value most first.

It’s easy to get overwhelmed. Some people look at their bank account and purely based on the number, think “Man I’m not doing that well, maybe I should start working more, or spending less.” The truth is, if you can cover your needs, you have an emergency savings, you contribute to your retirement account, and your sinking funds are on their way to being completed by their expected due date, you are totally fine. Finding balance is important to our wellbeing, and if you are hitting every mark you set for yourself, you don’t need to work more for the sake of money itself.

Lastly, limit impulse spending.

This is a difficult one, but in order to be spending intentionally we spend on our goals and the things we truly want, then cut out everything else.

One tip to limit impulse spending is to use a wishlist. Every time you feel the urge to buy something, write it down, and keep track of the date. If you realize that this is something that you find yourself wanting over and over again, then make a plan to buy it.

Another tip is to budget specifically for impulse spending. A lot of impulse spending is emotionally charged. Maybe you’ve had a bad day and just need a nice cup of coffee, maybe you had a big accomplishment and wanted to give yourself a little treat, either way we impulsively spend to give ourselves satisfaction. If you know that making those types of purchases is important to help you cope with stress or self-regulate, then set aside money for it.

Living intentionally is a huge topic that whole books have been written on. At its core, it aligns us with purpose and lets us spend time and money on what truly matters to us. I recommend that everyone practice a little bit of intentionality in their daily lives, even outside of money. If you want to explore more of what it means to live intentionally I recommend reaching out to the Center for Campus Wellness.

If you would like to sign up to join our next intentional spending challenge you can join the e-mailing list here

Images taken from behaviorgap.com

Categories

- Advice

- Budgeting

- Business

- Consumer

- Credit

- Credit Cards

- Credit Repair

- Credit Score

- Dating

- Expenses

- Fair Wages

- Finances

- Financial Preparation

- Financing

- Goals

- History

- Holidays

- Inflation

- Investing

- Love

- Money

- Pandemic

- Personal Finance

- Planning

- Ratios

- Savings

- Self Care

- Service Industry

- Spending

- Students

- Tipflation

- Tipping

- Travel