Why You Should Pay Attention to Investment Fees

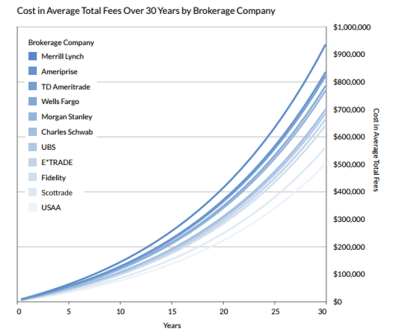

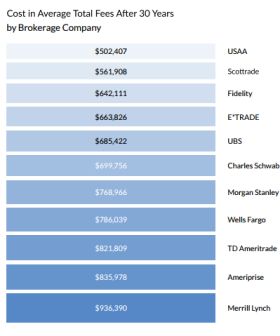

Investing can be a great way to provide future income and grow your savings. When you begin investing, you may run into common mantras like invest young, diversify, buy low sell high. But one thing you may not have considered are the fees associated with your investment account. Fees can end up eating hundreds of thousands of dollars of your investment including retirement portfolios. A study done by Personal Capital took eleven companies and compared the cost of fees over 30 years. Merrill Lynch ranked #1 for the most fees costing investors $936,390 over 30 years. To compare, another well known brokerage, Fidelity, cost consumers $642,111-nearly 2/3 the price of Merrill Lynch. See below.

When you save for retirement, invest your savings or play around in the stock market,

you will pay fees to the managers of your accounts. Those fees can be applied in a

number of ways like a percentage of your total portfolio, front end charges (when

you buy), back end (when you sell) or a yearly percentage of the value of your investment.

The yearly percentage method of charging fees (also know as an expense ratio) can

be one of the most costly because you will still pay even if your portfolio has a

negative return for the year. Based on a Deloitte Study for the Investment Company Institute (ICI), the median expense ratio of surveyed plans was .78%. Use this measure when evaluating

the fees on your investment.

When you save for retirement, invest your savings or play around in the stock market,

you will pay fees to the managers of your accounts. Those fees can be applied in a

number of ways like a percentage of your total portfolio, front end charges (when

you buy), back end (when you sell) or a yearly percentage of the value of your investment.

The yearly percentage method of charging fees (also know as an expense ratio) can

be one of the most costly because you will still pay even if your portfolio has a

negative return for the year. Based on a Deloitte Study for the Investment Company Institute (ICI), the median expense ratio of surveyed plans was .78%. Use this measure when evaluating

the fees on your investment.

Even if your investment is a fraction of a percent higher than another account, you will really pay for it later. If the capital currently lost to fees remained invested in retirement, savings could increase by an equally significant amount. At 1.98% for overall fees, Merrill Lynch was the worst offender in costs related to fees on retirement savings investments. At 1.06% in average total fee percentage, USAA had the lowest overall average total fee percentage of the eleven selected brokerages but still higher than the ICI study.

Pay attention before buying any investment product. Do your research and compare several brokers before you commit. As you can see from the graph, the company you choose can affect your return. The devil is in the fees.

About the Blog

The Financial Wellness Center's discussion channel for insightful chat about our events, news, and activities.