Navigating the Healthcare System: 5 Things to Know

As the infamous campus plague begins to spread, the sound of sneezes and sniffles echoes through lectures and hallways. No matter how vigilant we may be, sometimes getting sick is inevitable, and it is best to be prepared before you find yourself surrounded by tissues and cough drops. This post will focus on five things to know before you find yourself in the doctor’s office and will help you protect yourself and your wallet.

1. Insurance

Insurance is the number one tool for keeping healthcare costs down. For those of you currently covered: don’t forget to bring your insurance card to any appointments that you make. This is the easiest way to determine if you will be offered coverage. You may have two insurance cards: one for healthcare and one for the dentist or vision. Keep both with you! If you are currently uninsured, check to see if you qualify for Medicaid, or consider visiting a free clinic! If you need help accessing or navigating Medicaid, drop by the Basic Needs Collective!

2. Billing

Healthcare billing has a few unique aspects that can catch you off guard if you aren’t

careful. First, be prepared for the bills to come in waves. At certain emergency rooms

and urgent cares, the provider that you see may or may not be contracted with the

healthcare system. If this is the case, you will receive two bills. The first will

come from the organization, and the second will come from the provider that you saw.

If you are unsure, you can always double check by calling the facility. Always double

check instead of throwing out bills that you think you’ve already paid!

Healthcare billing has a few unique aspects that can catch you off guard if you aren’t

careful. First, be prepared for the bills to come in waves. At certain emergency rooms

and urgent cares, the provider that you see may or may not be contracted with the

healthcare system. If this is the case, you will receive two bills. The first will

come from the organization, and the second will come from the provider that you saw.

If you are unsure, you can always double check by calling the facility. Always double

check instead of throwing out bills that you think you’ve already paid!

3. Post-Visit Costs

Something else that is important to keep in mind when budgeting for healthcare expenses is any costs that may be associated with post-visit care. This can include anything from any medications that you have been prescribed to physical therapy. Make sure you know if your insurance will cover pharmaceutical or rehabilitative expenses. Some insurance providers will only provide rehabilitative care with a demonstrated need directive from your provider or may only cover the generic brand of a prescribed drug. Ask your pharmacist or health care provider to see if there is a generic brand of your medication to help bring costs down! Additionally, be aware of which organizations your healthcare plan covers.

4. Practicing Discernment

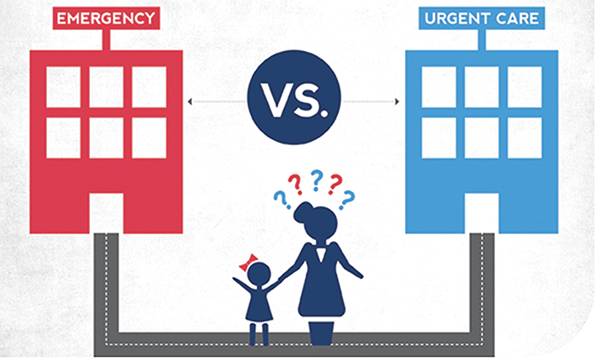

Another straightforward way to keep your healthcare costs down is to know the correct

place for you to visit. There is a substantial difference between the cost of an ER

visit and urgent care. Linked is a chart that can help you determine where to go based on your symptoms and severity. For routine appointments, scans, and checkups,

see a primary care provider. Knowing where to go is an incredibly important part of

budgeting for healthcare expenses.

Another straightforward way to keep your healthcare costs down is to know the correct

place for you to visit. There is a substantial difference between the cost of an ER

visit and urgent care. Linked is a chart that can help you determine where to go based on your symptoms and severity. For routine appointments, scans, and checkups,

see a primary care provider. Knowing where to go is an incredibly important part of

budgeting for healthcare expenses.

5. Be Aware of Your Options

Finally, it is important to recall that as a patient, you have rights. If you feel like you are being unfairly charged or billed, you can always request an itemized bill and check your medical bills for accuracy. Do not be afraid to advocate for yourself or seek a second opinion. In addition to this, many hospitals and charitable organizations offer financial assistance programs to help cover medical bills. While it’s not guaranteed, asking your healthcare provider about your options could provide useful support.

The healthcare system can undoubtedly be a complex landscape to navigate, but with the right tools you can be empowered financially and in your wellness. We’ll be with you every step of the way, and if you are feeling stressed about medical expenses feel free to schedule a one on one appointment with one of our financial counselors or visit the peer well-being navigators at the Center for Campus Wellness! Stay wealthy, stay healthy!