Investment Fundamentals

Investing is something that everyone needs to do at some point in their life, and the sooner the better. In this article I am going to outline 3 basic fundamentals to investing that everyone should know about.

First and foremost, don’t invest money into the stock market that you may need in the near future. A lot of people that I meet view the stock market as some sort of get rich quick scheme, and it is anything but that. During the last year we have witnessed billions of dollars wiped out form the stock market and many people left hanging after an incredible bull run during the covid pandemic. A basic first principle is to only invest money that you can set aside and leave in the market for at least 5 years at the minimum. But keep in mind, the ultimate goal is to never take it out, because the longer it can grow and compound the better off you will be.

The next principle is don't wait to purchase stocks, purchase stocks and wait. For

the average investor, timing market cycles is extremely difficult, and some finance

academics would even say impossible. Trying to time the bottom of the market or sell

at the very top is a game that nobody is going to win when they play. Instead of trying

to wait for the economy to collapse, it is historically a lot better to purchase stocks

consistently over a long period of time using dollar cost averaging. This strategy

can be explained quite easily, set up a timed automated investment schedule through

your brokerage. Over time the stock market goes up, and goes down, so if you invest

a set number of dollars consistently over a given period, then you will statistically

get more shares when the stock market is cheaper, and less shares on more expensive

days. Over time this phenomenon averages out to work extremely well for investors.

Some of the most common schedules people use for dollar cost averaging are daily,

weekly, or monthly.

The next principle is don't wait to purchase stocks, purchase stocks and wait. For

the average investor, timing market cycles is extremely difficult, and some finance

academics would even say impossible. Trying to time the bottom of the market or sell

at the very top is a game that nobody is going to win when they play. Instead of trying

to wait for the economy to collapse, it is historically a lot better to purchase stocks

consistently over a long period of time using dollar cost averaging. This strategy

can be explained quite easily, set up a timed automated investment schedule through

your brokerage. Over time the stock market goes up, and goes down, so if you invest

a set number of dollars consistently over a given period, then you will statistically

get more shares when the stock market is cheaper, and less shares on more expensive

days. Over time this phenomenon averages out to work extremely well for investors.

Some of the most common schedules people use for dollar cost averaging are daily,

weekly, or monthly.

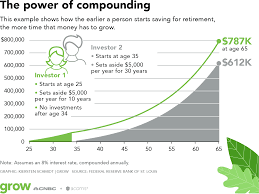

Last but not least, investing more money later, is not nearly as good as investing less money sooner. What I mean by this is a lot of people are initially turned off by investing because they may not have that much money to start with. Fortunately, these days most brokerages now let you invest with as little as one dollar. The reason It is very important to start sooner rather than later is largely due to the way compounding works. I will attach a graphic below to explain it better in more detail, because it demonstrates this a lot better than words can.