Budgeting for the Upcoming School Year

Now that August has begun, this means we are knocking on the door of our fall semester. Not only do you get a new semester with new classes and new opportunities, you also get lots of new expenses! How nice would it be to not have to stress about your finances at all this semester? I think everyone can agree that would be very nice! The absolute best way to not stress about finances is to make a plan and stick to it. This financial plan is called a budget. In the following paragraphs I am going to outline the best way to make a budget for this fall and stick to it!

Step 1:

The first step is to first track and write down all of your expenses. My favorite way to do this is to go to your debit or credit card account and see exactly how much you are spending on what. After that, you can also go to your bank account and see how much money is coming in from your work, side hustles, allowance, etc.

Step 2:

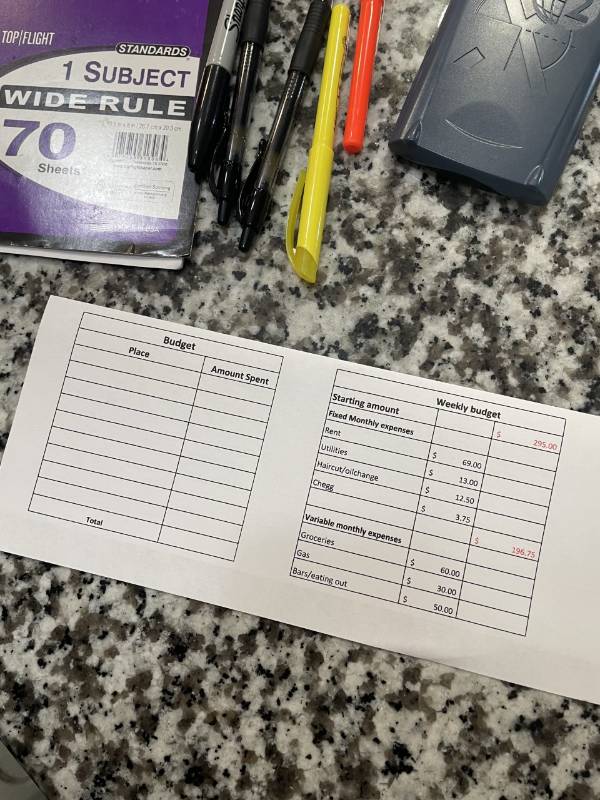

For the next step you will want to get out a piece of paper and write down exactly how much money you want to be spending in certain categories. For example, the most common place I see students spending too much money on is eating out. If you are eating out too much and you only want to eat out once a week, you can write down that you are only going to spend $20 a week on eating out. On this piece of paper you should also put fixed expenses such as rent and utilities, but also variable expenses like food and money to go out on the weekends.

Pro tip:

A common mistake I see people make when they first start to budget is they have expenses that usually wouldn’t fit in their monthly budget that can throw them off. A good example of these are oil changes or a haircut. Things that usually you need to pay for every quarter but not every month. My advice is to make sure and budget these more erratic expenses in your budget anyway! Say you budget $50 for a haircut or oil change every month and you don’t end up needing either of them, then you have an extra $50 to spend, save, or invest!

Step 3:

Discipline is the absolute hardest part of a budget and like the old adage goes discipline equals freedom! If you can build the discipline to stick to your budget and get your finances under control I promise it is so much more rewarding than your daily Starbucks run, or your late night door dash order. Finances always score really high on people's stress levels and getting your finances under control can be extremely rewarding and stress relieving.

As always if you need any help creating a budget or have any more questions regarding finances please come visit the Financial Wellness Center! We have certified financial counselors and student peer mentors who are available to all students and staff for free!

If you would like to schedule an appointment please visit our website or we also take walk-ins at our office on the third floor of the student union room 317.